Recently I responded to a Quantitative Finance forum question here, where I invited the questioner to peruse certain posts on this blog. Apparently the posts do not provide enough information to fully answer the question (my bad) and therefore this post provides what I think will suffice as a full and complete reply, although perhaps not scientifically rigorous.

The original question asked was "Is it possible to separate or decouple the two currencies in a trading pair?" and I believe what I have previously described as a "currency strength indicator" does precisely this (blog search term ---> https://dekalogblog.blogspot.com/search?q=currency+strength+indicator). This post outlines the rationale behind my approach.

Take, for example, the GBPUSD forex pair, and further give it a current (imaginary) value of 1.2500. What does this mean? Of course it means 1 GBP will currently buy you 1.25 USD, or alternatively 1 USD will buy you 1/1.25 = 0.8 GBP. Now rather than write GBPUSD let's express GBPUSD as a ratio thus:- GBP/USD, which expresses the idea of "how many USD are there in a GBP?" in the same way that 9/3 shows how many 3s there are in 9. Now let's imagine at some time period later there is a new pair value, a lower case "gbp/usd" where we can write the relationship

(1) ( GBP / USD ) * ( G / U ) = gbp / usd

to show the change over the time period in question. The ( G / U ) term is a multiplicative term to show the change in value from old GBP/USD 1.2500 to say new value gbp/usd of 1.2600,

e.g. ( G / U ) == ( gbp / usd ) / ( GBP / USD ) == 1.26 / 1.25 == 1.008

from which it is clear that the forex pair has increased by 0.8% in value over this time period. Now, if we imagine that over this time period the underlying, real value of USD has remained unchanged this is equivalent to setting the value U in ( G / U ) to exactly 1, thereby implying that the 0.8% increase in the forex pair value is entirely attributable to a 0.8% increase in the underlying, real value of GBP, i.e. G == 1.008. Alternatively, we can assume that the value of GBP remains unchanged,

e.g. G == 1, which means that U == 1 / 1.008 == 0.9921

which implies that a ( 1 - 0.9921 ) == 0.79% decrease in USD value is responsible for the 0.8% increase in the pair quote.

Of course, given only equation (1) it is impossible to solve for G and U as either can be arbitrarily set to any number greater than zero and then be compensated for by setting the other number such that the constant ( G / U ) will match the required constant to account for the change in the pair value.

However, now let's introduce two other forex pairs (2) and (3) and thus we have:-

(1) ( GBP / USD ) * ( G / U ) = gbp / usd

(2) ( EUR / USD ) * ( E / U ) = eur / usd

(3) ( EUR / GBP ) * ( E / G ) = eur / gbp

We now have three equations and three unknowns, namely G, E and U, and so this system of equations could be laboriously, mathematically solved by substitution.

However, in my currency strength indicator I have taken a different approach. Instead of solving mathematically I have written an error function which takes as arguments a list of G, E, U, ... etc. for all currency multipliers relevant to all the forex quotes I have access to, approximately 47 various crosses which themselves are inputs to the error function, and this function is supplied to Octave's fminunc function to simultaneously solve for all G, E, U, ... etc. given all forex market quotes. The initial starting values for all G, E, U, ... etc. are 1, implying no change in values across the market. These starting values consistently converge to the same final values for G, E, U, ... etc for each separate period's optimisation iterations.

Having got all G, E, U, ... etc. what can be done? Well, taking G for example, we can write

(4) GBP * G = gbp

for the underlying, real change in the value of GBP. Dividing each side of (4) by GBP and taking logs we get

(5) log( G ) = log( gbp / GBP )

i.e. the log of the fminunc returned value for the multiplicative constant G is the equivalent of the log return of GBP independent of all other currencies, or as the original forum question asked, the (change in) value of GBP separated or decoupled the from the pair in which it is quoted.

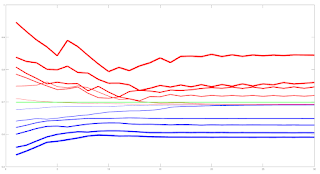

Of course, having the individual log returns of separated or decoupled currencies, there are many things that can be done with them, such as:-

- create indices for each currency

- apply technical analysis to these separate indices

- intermarket currency analysis

- input to machine learning (ML) models

- possibly create new and unique currency indicators

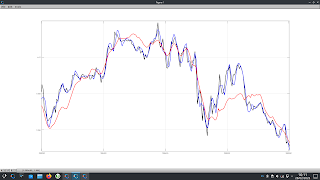

Examples of the creation of "alternative price charts" and indices are shown below

where the black line is the actual 10 minute closing prices of GBPUSD over the

last week (13th to 18th August) with the corresponding GBP price (blue line) being the "alternative" GBPUSD chart if U is held at 1 in the ( G / U ) term and G allowed to be its derived, optimised value, and the USD price (red line) being the alternative chart if G is held at 1 and U allowed to be its derived, optimised value.

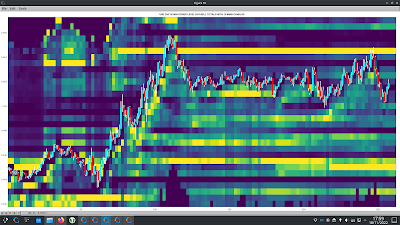

This second chart shows a more "traditional" index like chart

where the starting values are 1 and both the G and U values take their derived values. As can be seen, over the week there was upwards momentum in both the GBP and USD, with the greater momentum being in the GBP resulting in a higher GBPUSD quote at the end of the week. If, in the second chart the blue GBP line had been flat at a value of 1 all week, the upwards momentum in USD would have resulted in a lower week ending quoted value of GBPUSD, as seen in the red USD line in the first chart. Having access to these real, decoupled returns allows one to see through the given, quoted forex prices in the manner of viewing the market as though through X-ray vision.

I hope readers find this post enlightening, and if you find some other uses for this idea, I would be interested in hearing how you use it.