Since my last post I have been working on the process noise covariance matrix Q, with a view to optimising both the Q and R matrices for an

Extended Kalman filter to model the cyclic component of price action as a

Sine wave. However, my work to date has produced unsatisfactory results and I have decided to give up trying to make it work.

The reasons for this failure are unclear to me, and I don't intend to spend any more time investigating, but some educated guesses are that the underlying model of sinusoid is mismatched and my estimation of the process and/or measurement noise variances is lacking; either way, the end result is that the EKF is diverging and my earlier

leading signal 1,

leading signal 2 and

leading signal 3 posts outline what I think will be a more promising line of investigation in the future.

Nevertheless, below I provide the rough working code that I have been using in my EKF work, and maybe readers will find something of value in it. There is a lot of commenting and some blocked out code and I'm afraid readers will have to wade through this as best they can.

clear all ;

1 ;

pkg load signal ;

% function declarations

%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%

function Y = ekf_sine_h( x )

% Measurement model function for the sine signal.

% Takes the state input vector x of sine, phase, angular frequency and amplitude and

% calculates the current value of the sine given the state vector values.

f = x( 2 , : ) ; % phase value in radians

a = x( 4 , : ) ; % amplitude

Y = a .* sin( f ) ; % the sine value

endfunction

%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%

%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%

function [ cost ] = sine_ekf_Q_optim( Q_mult , data , targets , Q , R )

% initial state from noisy data input measurements

s = data( : , 1 ) ;

n = size( data , 1 ) ;

% initial state covariance

P = eye( n ) ;

% allocate memory

xV = zeros( size( data ) ) ; % record estmates of states

% basic Jacobian of state transition matrix

A = [ 0 0 0 0 ; % sine value

0 1 1 0 ; % phase

0 0 1 0 ; % angular frequency

0 0 0 1 ] ; % amplitude

H = eye( n ) ; % measurement matrix

Q = Q_mult .* Q ;

for k = 2 : size( data , 2 )

% do ekf

% nonlinear update x and linearisation at current state s

x = s ;

x( 2 ) = x( 2 ) + x( 3 ) ; % advance phase value by angular frequency

x( 2 ) = mod( x( 2 ) , 2 * pi ) ; % limit phase values to range 0 --- 2 * pi

x( 1 ) = x( 4 ) * sin( x( 2 ) ) ; % sine value calculation

% update the 1st row of the jacobian matrix at state vector s values

A( 1 , : ) = [ 0 s( 4 ) * cos( s( 2 ) ) 0 sin( s( 2 ) ) ] ;

P = A * P * A' + Q ; % state transition model update of covariance matrix P

measurement_residual = [ data( 1 , k ) - x( 1 ) ; % sine residual

data( 2 , k ) - x( 2 ) ; % phase residual

data( 3 , k ) - x( 3 ) ; % angular frequency residual

data( 4 , k ) - x( 4 ) ] ; % amplitude residual

innovation_residual_covariance = H * P * H' + R ;

kalman_gain = P * H' / innovation_residual_covariance ;

% update the state vector s with kalman_gain

s = x + kalman_gain * measurement_residual ;

% some reality based post hoc adjustments

s( 2 ) = abs( s( 2 ) ) ; % no negative phase values

s( 3 ) = abs( s( 3 ) ) ; % no negative angular frequencies

s( 4 ) = abs( s( 4 ) ) ; % no negative amplitudes

% update the state covariance matrix P

% NOTE

% The Joseph formula is given by P+ = ( I − KH ) P− ( I − KH )' + KRK', where I is the identity matrix,

% K is the gain, H is the measurement mapping matrix, R is the measurement noise covariance matrix,

% and P−, P+ are the pre and post measurement update estimation error covariance matrices, respectively.

% The optimal linear unbiased estimator (equivalently the optimal linear minimum mean square error estimator)

% or Kalman filter often utilizes simplified covariance update equations such as P+ = (I−KH)P− and P+ = P− −K(HP−H'+R)K'.

% While these alternative formulations require fewer computations than the Joseph formula, they are only valid

% when K is chosen as the optimal Kalman gain. In engineering applications, situations arise where the optimal

% Kalman gain is not utilized and the Joseph formula must be employed to update the estimation error covariance.

% Two examples of such a scenario are underweighting measurements and considering states.

% Even when the optimal gain is used, the Joseph formulation is still preferable because it possesses

% greater numerical accuracy than the simplified equations.

P = ( eye( n ) - kalman_gain * H ) * P * ( eye( n ) - kalman_gain * H )' + kalman_gain * R * kalman_gain' ;

xV( : , k ) = s ; % save estimated updated states

endfor

Y = ekf_sine_h( xV ) ;

cost = mean( ( Y( 4 : end - 3 ) .- targets( 4 : end - 3 ) ).^2 ) ;

%cost = mean( ( Y .- targets ).^2 ) ;

%output = xV( 1 , : ) ;

endfunction

%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%

%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%

function output = run_sine_ekf_Q_optim( data , Q , R )

% initial state from noisy data input measurements

s = data( : , 1 ) ;

n = size( data , 1 ) ;

% initial state covariance

P = eye( n ) ;

% allocate memory

xV = zeros( size( data ) ) ; % record estmates of states

% basic Jacobian of state transition matrix

A = [ 0 0 0 0 ; % sine value

0 1 1 0 ; % phase

0 0 1 0 ; % angular frequency

0 0 0 1 ] ; % amplitude

H = eye( n ) ; % measurement matrix

for k = 2 : size( data , 2 )

% do ekf

% nonlinear update x and linearisation at current state s

x = s ;

x( 2 ) = x( 2 ) + x( 3 ) ; % advance phase value by angular frequency

x( 2 ) = mod( x( 2 ) , 2 * pi ) ; % limit phase values to range 0 --- 2 * pi

x( 1 ) = x( 4 ) * sin( x( 2 ) ) ; % sine value calculation

% update the 1st row of the jacobian matrix at state vector s values

A( 1 , : ) = [ 0 s( 4 ) * cos( s( 2 ) ) 0 sin( s( 2 ) ) ] ;

P = A * P * A' + Q ; % state transition model update of covariance matrix P

measurement_residual = [ data( 1 , k ) - x( 1 ) ; % sine residual

data( 2 , k ) - x( 2 ) ; % phase residual

data( 3 , k ) - x( 3 ) ; % angular frequency residual

data( 4 , k ) - x( 4 ) ] ; % amplitude residual

innovation_residual_covariance = H * P * H' + R ;

kalman_gain = P * H' / innovation_residual_covariance ;

% update the state vector s with kalman_gain

s = x + kalman_gain * measurement_residual ;

% some reality based post hoc adjustments

s( 2 ) = abs( s( 2 ) ) ; % no negative phase values

s( 3 ) = abs( s( 3 ) ) ; % no negative angular frequencies

s( 4 ) = abs( s( 4 ) ) ; % no negative amplitudes

% update the state covariance matrix P

% NOTE

% The Joseph formula is given by P+ = ( I − KH ) P− ( I − KH )' + KRK', where I is the identity matrix,

% K is the gain, H is the measurement mapping matrix, R is the measurement noise covariance matrix,

% and P−, P+ are the pre and post measurement update estimation error covariance matrices, respectively.

% The optimal linear unbiased estimator (equivalently the optimal linear minimum mean square error estimator)

% or Kalman filter often utilizes simplified covariance update equations such as P+ = (I−KH)P− and P+ = P− −K(HP−H'+R)K'.

% While these alternative formulations require fewer computations than the Joseph formula, they are only valid

% when K is chosen as the optimal Kalman gain. In engineering applications, situations arise where the optimal

% Kalman gain is not utilized and the Joseph formula must be employed to update the estimation error covariance.

% Two examples of such a scenario are underweighting measurements and considering states.

% Even when the optimal gain is used, the Joseph formulation is still preferable because it possesses

% greater numerical accuracy than the simplified equations.

P = ( eye( n ) - kalman_gain * H ) * P * ( eye( n ) - kalman_gain * H )' + kalman_gain * R * kalman_gain' ;

xV( : , k ) = s ; % save estimated updated states

endfor

output = xV ;

endfunction

%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%

%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%

% load data

cd /home/dekalog/Documents/octave/indices ;

raw_data = dlmread( 'raw_data_for_indices_and_strengths' ) ;

delete_hkd_crosses = [ 3 9 12 18 26 31 34 39 43 51 61 ] .+ 1 ; % +1 to account for date column

raw_data( : , delete_hkd_crosses ) = [] ;

raw_data( : , 1 ) = [] ; % delete date vector

% so now

% 1 2 3 4 5 6 7 8 9 10 11 12 13 14

% aud_cad aud_chf aud_jpy aud_nzd aud_sgd aud_usd cad_chf cad_jpy cad_sgd chf_jpy eur_aud eur_cad eur_chf eur_gbp

%

% 15 16 17 18 19 20 21 22 23 24 25 26 27 28

% eur_jpy eur_nzd eur_sgd eur_usd gbp_aud gbp_cad gbp_chf gbp_jpy gbp_nzd gbp_sgd gbp_usd nzd_cad nzd_chf nzd_jpy

%

% 29 30 31 32 33 34 35 36 37 38 39 40 41 42

% nzd_sgd nzd_usd sgd_chf sgd_jpy usd_cad usd_chf usd_jpy usd_sgd xag_aud xag_cad xag_chf xag_eur xag_gbp xag_jpy

%

% 43 44 45 46 47 48 49 50 51 52 53 54 55

% xag_nzd xag_sgd xag_usd xau_aud xau_cad xau_chf xau_eur xau_gbp xau_jpy xau_nzd xau_sgd xau_usd xau_xag

% aud_x = x(1) ; cad_x = x(2) ; chf_x = x(3) ; eur_x = x(4) ; gbp_x = x(5) ; hkd_x = x(6) ;

% jpy_x = x(7) ; nzd_x = x(8) ; sgd_x = x(9) ; usd_x = x(10) ; gold_x = x(11) ; silver_x = x(12) ;

all_g_c = dlmread( "all_g_mults_c" ) ; % the currency g mults

all_g_c( : , 7 ) = [] ; % delete hkd index

all_g_s = dlmread( "all_g_sv" ) ; % the gold and silver g mults

all_g_c = [ all_g_c all_g_s(:,2:3) ] ; % a combination of the above 2

all_g_c( : , 2 : end ) = cumprod( all_g_c( : , 2 : end) , 1 ) ;

all_g_c( : , 1 ) = [] ; % delete date vector

% so now index ix are

% aud_x = 56 ; cad_x = 57 ; chf_x = 58 ; eur_x = 59 ; gbp_x = 60 ; jpy_x = 61 ;

% nzd_x = 62 ; sgd_x = 63 ; usd_x = 64 ; gold_x = 65 ; silver_x = 66 ;

all_raw_data = [ raw_data all_g_c ] ; clear -x all_raw_data ;

%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%

cd /home/dekalog/Documents/octave/kalman/ekf ;

## >> bs_phase_error = mean( all_bootstrap_means(:,1)) + 2 * std( all_bootstrap_means(:,1))

## bs_phase_error = 0.50319

## >> bs_period_ang_frequency_error = mean( all_bootstrap_means(:,2)) + 2 * std( all_bootstrap_means(:,2))

## bs_period_ang_frequency_error = 0.17097

## >> bs_amp_error = mean( all_bootstrap_means(:,3)) + 2 * std( all_bootstrap_means(:,3))

## bs_amp_error = 0.18179

price_ix = 65 ;

price = all_raw_data( : , price_ix ) ; % plot(price) ;

%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%

% get measurements of price action

period = autocorrelation_periodogram( price ) ;

measured_angular_frequency = ( 2 * pi ) ./ period ; % plot( measured_angular_frequency ) ;

trend = sma( price , period ) ;

cycle = price .- trend ;

%smooth_cycle = sgolayfilt( cycle , 2 , 7 ) ;

smooth_cycle = smooth_2_5( cycle ) ;

% plot( price,'k',trend,'r') ;

[ ~ , ~ , ~ , ~ , ~ , ~ , measured_phase ] = sinewave_indicator( cycle ) ; % figure(1) ; plot( deg2rad( measured_phase ) ) ;

% figure(2) ; plot( sin( deg2rad(measured_phase)) ) ;

measured_phase = mod( unwrap( deg2rad( measured_phase ) ) , 2 * pi ) ; % figure(1) ; hold on ; plot( measured_phase , 'r' ) ; hold off ;

% figure(2) ; hold on ; plot( sin( measured_phase)) ; hold off ;

measured_amplitude = cycle ;

for ii = 50 : length( cycle ) ;

measured_amplitude( ii ) = sqrt( 2 ) * sqrt( mean( cycle( ii - period( ii ) : ii ).^2 ) ) ;

endfor % end ii loop

% plot(measured_amplitude) ;

%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%%

% run the ekf optimisation

ekf_cycle = cycle ;

% complete values for R matrix for this data set

data = [ smooth_cycle( 101 : end ) measured_phase( 101 : end ) measured_angular_frequency( 101 : end ) measured_amplitude( 101 : end ) ]' ;

%measured_sine = sgolayfilt( data( 1 , : ) , 2 , 7 ) ; % figure(1) ; plot( data( 1 , : ) , 'k' , measured_sine , 'r' ) ;

measured_sine = smooth_cycle( 101 : end )' ;

R( 1 , 1 ) = mean( ( data( 1 , : ) .- measured_sine ).^2 ) ; % variance of sine wave value measurements

R( 3 , 3 ) = mean( ( data( 3 , : ) .* 0.17 ).^2 ) ; % variance of angular frequency measurements

R( 4 , 4 ) = mean( ( data( 4 , : ) .* 0.18 ).^2 ) ; % variance of amplitude measurements

% get initial process covariance matrix Q

Q = analytical_shrinkage( data' ) ;

Q = 0.1 .* Q ;

lookback = 200 ;

%for ii = 301 : length( price )

% complete values for R matrix for this data set

data = [ smooth_cycle(ii-lookback:ii) measured_phase(ii-lookback:ii) measured_angular_frequency(ii-lookback:ii) measured_amplitude(ii-lookback:ii) ]' ;

%measured_sine = sgolayfilt( data( 1 , : ) , 2 , 7 ) ; % figure(1) ; plot( data( 1 , : ) , 'k' , measured_sine , 'r' ) ;

measured_sine = cycle( ii - lookback : ii )' ;

R( 1 , 1 ) = mean( ( data( 1 , : ) .- measured_sine ).^2 ) ; % variance of sine wave value measurements

R( 3 , 3 ) = mean( ( data( 3 , : ) .* 0.17 ).^2 ) ; % variance of angular frequency measurements

R( 4 , 4 ) = mean( ( data( 4 , : ) .* 0.18 ).^2 ) ; % variance of amplitude measurements

% Q = analytical_shrinkage( data' ) ;

% optimise the Q matrix for this data set

% declare optimisation function

f = @( Q_mult ) sine_ekf_Q_optim( Q_mult , data , smooth_cycle( ii - lookback : ii )' , Q , R ) ;

% Set options for fminunc

options = optimset( "MaxIter" , 50 ) ;

% initial value

Q_mult = 1 ;

Q_mult = fminunc( f , Q_mult , options ) ;

% adjust Q by optimised Q_mult

Q = Q_mult .* Q ;

output = run_sine_ekf_Q_optim( data , Q , R ) ;

%ekf_cycle( ii ) = ekf_sine_h( output( : , end ) ) ;

ekf_cycle = ekf_sine_h( output ) ;

figure(1) ; subplot( 4 , 1 , 1 ) ; plot( data( 1 , : ) , 'k' , 'linewidth' , 2 , ekf_sine_h( output ) , 'r' , 'linewidth' , 2 ) ;

title( 'High Pass' ) ; legend( 'Measured' , 'EKF Estimated' ) ;

figure(1) ; subplot( 4 , 1 , 2 ) ; plot( data( 2 , : ) , 'k' , 'linewidth' , 2 , output( 2 , : ) , 'r' , 'linewidth' , 2 ) ;

title( 'High Pass Phase' ) ; legend( 'Measured' , 'EKF Estimated' ) ;

figure(1) ; subplot( 4 , 1 , 3 ) ; plot( data( 3 , : ) , 'k' , 'linewidth' , 2 , output( 3 , : ) , 'r' , 'linewidth' , 2 ) ;

title( 'High Pass Angular Frequency' ) ; legend( 'Measured' , 'EKF Estimated' ) ;

figure(1) ; subplot( 4 , 1 , 4 ) ; plot( data( 4 , : ) , 'k' , 'linewidth' , 2 , output( 4 , : ) , 'r' , 'linewidth' , 2 ) ;

title( 'High Pass Amplitude' ) ; legend( 'Measured' , 'EKF Estimated' ) ;

%endfor

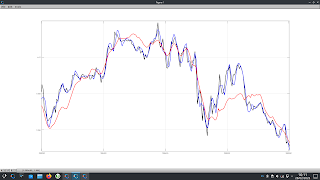

figure(1) ; plot( cycle(101:end)' , 'k' , 'linewidth' , 2 , ekf_cycle , 'r' , 'linewidth' , 2 , output(1,:) , 'b' ) ;

figure(2) ; plot( price(101:end) , 'k' , 'linewidth' , 2 , trend(101:end).+ekf_cycle' , 'r' , 'linewidth' , 2 ) ;

One thing I will point out is the use of a function called

analytical_shrinkage, which I have taken directly from a recent paper,

Analytical Nonlinear Shrinkage of Large-Dimensional Covariance Matrices, the MATLAB code being provided as an appendix in the paper. Readers may find this to be particularly useful outside the use I have tried putting it to.

Next week I shall go on my customary, summer working holiday and be away from home until August: therefore there will be a hiatus in blog posts until my return.