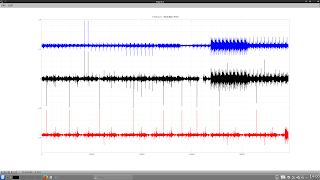

Being able to plot like this avoids the necessity to keep flipping between two separate charts to compare the plot of a potential input feature and a plot of price. So, without further ado, here is the code for the function:

## Copyright (C) 2018 dekalog

##

## This program is free software; you can redistribute it and/or modify it

## under the terms of the GNU General Public License as published by

## the Free Software Foundation; either version 3 of the License, or

## (at your option) any later version.

##

## This program is distributed in the hope that it will be useful,

## but WITHOUT ANY WARRANTY; without even the implied warranty of

## MERCHANTABILITY or FITNESS FOR A PARTICULAR PURPOSE. See the

## GNU General Public License for more details.

##

## You should have received a copy of the GNU General Public License

## along with this program. If not, see .

## -*- texinfo -*-

## @deftypefn {} {@var{retval} =} bull_bear_background_plot (@var{price}, @var{condition})

##

## Plots price with different, vertically coloured background stripes, according

## to the integer values 1, 2... etc contained in condition.

##

## see https://web.njit.edu/~kevin/rgb.txt.html for colour codes

##

## @seealso{}

## @end deftypefn

## Author: dekalog

## Created: 2018-10-17

function [retval] = bull_bear_background_plot ( price , condition )

% if price is a row vector, change it to a column vector

if ( size( price , 1 ) == 1 && size( price , 2 ) > 1 )

price = price' ;

endif

up_lim = max( price ) ; low_lim = min( price ) ;

x = [ 1 : size( price , 1 ) ]' ;

y = unique( condition ) ;

ix1 = find( condition == y(1) ) ; color1 = [ 173 216 230 ] ./ 255 ; % LightBlue

ix2 = find( condition == y(2) ) ; color2 = [ 255 228 225 ] ./ 255 ; % MistyRose

if ( low_lim >= 0 ) % all prices are positive; normal for a price chart

bar( x(ix1) , ones(size(ix1)).*(1.05*up_lim) , 1 , 'facecolor' , color1 , 'edgecolor' , color1 ) ; hold on ;

bar( x(ix2) , ones(size(ix2)).*(1.05*up_lim) , 1 , 'facecolor' , color2 , 'edgecolor' , color2 ) ;

plot( price , 'k' , 'linewidth' , 2 ) ; axis([min(x),max(x),0.95*low_lim,1.05*up_lim]) ; grid minor on ; hold off ;

elseif ( up_lim > 0 && low_lim < 0 ) % plotting an ocscillator around a zero line

% or perhaps some negative back-adjusted prices

bar( x(ix1) , ones(size(ix1)).*(1.05*up_lim) , 1 , 'facecolor' , color1 , 'edgecolor' , color1 ) ; hold on ;

bar( x(ix1) , ones(size(ix1)).*(1.05*low_lim) , 1 , 'facecolor' , color1 , 'edgecolor' , color1 ) ; ;

bar( x(ix2) , ones(size(ix2)).*(1.05*up_lim) , 1 , 'facecolor' , color2 , 'edgecolor' , color2 ) ;

bar( x(ix2) , ones(size(ix2)).*(1.05*low_lim) , 1 , 'facecolor' , color2 , 'edgecolor' , color2 ) ;

plot( price , 'k' , 'linewidth' , 2 ) ; grid minor on ; hold off ;

elseif ( up_lim < 0 ) % all prices are negative

bar( x(ix1) , ones(size(ix1)).*(1.05*low_lim) , 1 , 'facecolor' , color1 , 'edgecolor' , color1 ) ; hold on ;

bar( x(ix2) , ones(size(ix2)).*(1.05*low_lim) , 1 , 'facecolor' , color2 , 'edgecolor' , color2 ) ;

plot( price , 'k' , 'linewidth' , 2 ) ; axis([min(x),max(x),1.05*low_lim,0.95*up_lim]) ; grid minor on ; hold off ;

endif

endfunction

with the light blue background highlighting an uptrend and the MistyRose highlighting a downtrend in the black sine wave plot. At the moment the function is not very polished and is hard coded for only these two colours, but it would be a trivial task to extend its functionality to more than two conditions and have the colours as a user input. However, this is low down on my list of priorities at the moment. I hope readers who use Octave as I do find this function useful.