"Trading is statistics and time series analysis." This blog details my progress in developing a systematic trading system for use on the futures and forex markets, with discussion of the various indicators and other inputs used in the creation of the system. Also discussed are some of the issues/problems encountered during this development process. Within the blog posts there are links to other web pages that are/have been useful to me.

Monday, 9 September 2013

Update on FFT Smoother

Having tested the FFT smoother on real price data and having been disappointed, I have decided not to pursue this any further for the moment. I think the problem is that for such short input periods ( 10 to 50 bars ) the FFT does not have enough frequency resolution and that by eliminating most of the frequencies from this short period I'm throwing out the baby with the bath water.

Wednesday, 4 September 2013

FFT Smoother Function Test

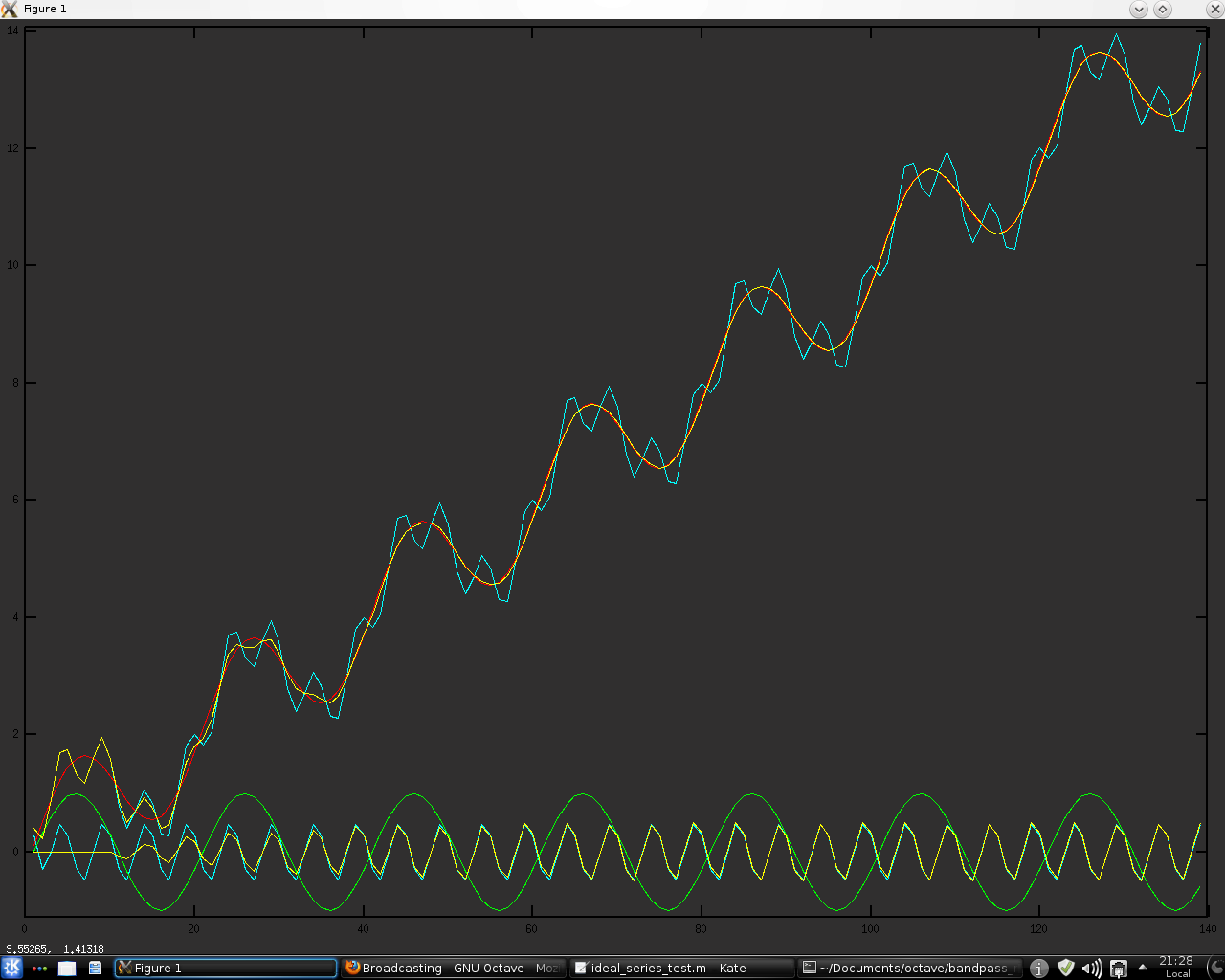

Following on from my last post I now want to show the FFT smoother function results on my usual idealised market data. The Octave script code for this test is given in the code box below.

where the underlying smooth "true" signal can now be seen in red. I think the performance of the magenta FFT smoother in recovering this "true" signal speaks for itself. My next post will show its performance on real price data.

clear all

% create the "price" vector

period = input( 'Enter period between 10 & 50 for underlying sine: ' ) ;

underlying_sine = sinewave( 500 , period ) ; % create underlying sinewave function with amplitude 2

trend_mult = input( 'Enter value for trend (a number between -4 & 4 incl.) to 4 decimal places: ' ) ;

trend = ( trend_mult / period ) .* (0:1:499) ;

noise_mult = input( 'Enter value for noise multiplier (a number between 0 & 1 incl.) to 2 decimal places: ' ) ;

noise = noise_mult * randn(500,1)' ;

smooth_price = underlying_sine .+ trend ;

price = underlying_sine .+ trend .+ noise ;

super_smooth = super_smoother( price ) ;

smooth = price ;

mean_value = price ;

mean_smooth = price ;

for ii = period+1 : length( price )

mean_value(ii) = mean( price( ii-period : ii ) ) ;

fft_input = price( ii-(period-1) : ii ) .- mean_value(ii) ;

N = length( fft_input ) ;

data_in_freq_domain = fft( fft_input ) ;

if mod( N , 2 ) == 0 % N even

% The DC component is unique and should not be altered

% adjust value of element N / 2 to compensate for it being the sum of frequencies

data_in_freq_domain( N / 2 ) = abs( data_in_freq_domain( N / 2 ) ) / 2 ;

[ max1 , ix1 ] = max( abs( data_in_freq_domain( 2 : N / 2 ) ) ) ; % get the index of the first max value

ix1 = ix1 + 1 ;

[ max2 , ix2 ] = max( abs( data_in_freq_domain( N / 2 + 1 : end ) ) ) ; % get index of the second max value

ix2 = N / 2 + ix2 ;

non_zero_values_ix = [ 1 ix1 ix2 ] ; % indices for DC component, +ve freq max & -ve freq max

else % N odd

% The DC component is unique and should not be altered

[ max1 , ix1 ] = max( abs( data_in_freq_domain( 2 : ( N + 1 ) / 2 ) ) ) ; % get the index of the first max value

ix1 = ix1 + 1 ;

[ max2 , ix2 ] = max( abs( data_in_freq_domain( ( N + 1 ) / 2 + 1 : end ) ) ) ; % get index of the second max value

ix2 = ( N + 1 ) / 2 + ix2 ;

non_zero_values_ix = [ 1 ix1 ix2 ] ; % indices for DC component, +ve freq max & -ve freq max

end

% extract the constant term and frequencies of interest

non_zero_values = data_in_freq_domain( non_zero_values_ix ) ;

% now set all values to zero

data_in_freq_domain( 1 : end ) = 0.0 ;

% replace the non_zero_values

data_in_freq_domain( non_zero_values_ix ) = non_zero_values ;

inv = ifft( data_in_freq_domain ) ; % reverse the FFT

recovered_sig = real( inv ) ; % recover the real component of ifft for plotting

smooth( ii ) = recovered_sig( end ) + mean_value( ii ) ;

mean_smooth( ii ) = mean( smooth( ii-period : ii ) ) ;

end

smooth = smooth .+ ( mean_value .- mean_smooth ) ;

plot( smooth_price , 'r' ,price , 'c' , smooth , 'm' , super_smooth , 'g' )

legend( 'smooth price' , 'price' , 'fft smooth' , 'super smooth' )- period = 20

- trend multiplier = 1.3333

- noise multiplier = 0.0

where the underlying smooth "true" signal can now be seen in red. I think the performance of the magenta FFT smoother in recovering this "true" signal speaks for itself. My next post will show its performance on real price data.

Monday, 2 September 2013

Filtering in the Frequency Domain with Octave's FFT Function

Despite my previous post in which I talked about the "Super Smoother" filter, it was bugging me that I couldn't get my attempts at FFT filtering to work. However, thanks in large part to my recent discovery of two online tutorials here and here I think I've finally cracked it. Taking these two tutorials as a template I have written an interactive Octave script, which is shown in the code box below.

The last chart output of the script will look something like this.

The red sinusoid represents an underlying periodic signal of period 20 and the green time series is a composite signal of the red line plus a 7 period sinusoid of less amplitude and random noise, these not being shown in the plot. The blue line is the resultant output of FFT filtering in the frequency domain of the green input. I must say I'm pretty pleased with this result and will be doing more work in this area shortly. Stay tuned!

clear all

fprintf( '\nThis is an interactive Octave tutorial to explain the basic principles\n' )

fprintf( 'of the Fast Fourier transform and how it can be used to smooth a time series\n' )

fprintf( 'in the frequency domain.\n\n' )

fprintf( 'A Fourier transform approximates any continuous function as the sum of periodic\n' )

fprintf( 'functions (sines and cosines). The FFT does the same thing for discrete signals,\n' )

fprintf( 'a series of data points rather than a continuously defined function.\n' )

fprintf( 'The FFT lets you identify periodic components in your discrete signal.\n' )

fprintf( 'You might need to identify a periodic signal buried under random noise,\n' )

fprintf( 'or analyze a signal with several different periodic underlying sources.\n' )

fprintf( 'Octave includes a built-in implementation of FFT to help you do this.\n\n' )

fprintf( 'First, take this 20 period sine wave. Since we know the period, the\n' )

fprintf( 'frequency = 1 / period = 1 / 20 = 0.05 Hz.\n\n' )

% set the period

period = 20 ;

underlying_sine = 2.0 .* sinewave( period , period ) ; % create underlying sinewave function with amplitude 2

plot( underlying_sine , 'b' )

title( 'A Sine Wave of period 20 with an amplitude of 2' )

fprintf( 'After viewing chart, press enter to continue.\n\n' )

pause ;

fprintf( 'Now, let us put this sine wave through the Octave fft function thus:\n\n' )

fprintf( ' data_in_freq_domain = fft( data ) ; and plot this.\n\n' )

N = length( underlying_sine ) ;

% If length of fft vector is even, then the magnitude of the fft will be symmetric, such that the

% first ( 1 + length / 2 ) points are unique, and the rest are symmetrically redundant. The DC component

% of output is fft( 1 ) and fft( 1 + length / 2 ) is the Nyquist frequency component of vector.

% If length is odd, however, the Nyquist frequency component is not evaluated, and the number of unique

% points is ( length + 1 ) / 2 . This can be generalized for both cases to ceil( ( length + 1 ) / 2 )

data_in_freq_domain = fft( underlying_sine ) ; % take the fft of our underlying_sine

stem( abs( data_in_freq_domain ) ) ; % use abs command to get the magnitude.

xlabel( 'Sample Number, i.e. position in the plotted Octave fft output vector' )

ylabel( 'Amplitude' )

title( 'Using the basic Octave fft command' )

grid

axis( [ 0 , period + 1 , 0 , max(abs( data_in_freq_domain )) + 0.1 ] )

fprintf( 'It can be seen that the x-axis gives us no information about the frequencies\n' )

fprintf( 'and the spectrum is not centered around zero. Changing the x-axis to frequency\n' )

fprintf( 'and plotting a centered frequency plot (see code in file) gives this plot.\n\n' )

fprintf( 'Press enter to view centered frequency plot.\n\n' )

pause ;

% Fs is the sampling rate

% this part of the code generates the frequency axis

if mod( N , 2 ) == 0

k = -N/2 : N/2-1 ; % N even

else

k = -(N-1)/2 : (N-1)/2 ; % N odd

end

T = N / 1 ; % where the frequency sampling rate Fs in T = N / Fs ; Fs is 1.

frequencyRange = k / T ; % the frequency axis

data_in_freq_domain = fft( underlying_sine ) / N ; % apply the FFT & normalize the data

centered_data_in_freq_domain = fftshift( data_in_freq_domain ) ; % shifts the fft data so that it is centered

% remember to take the abs of data_in_freq_domain to get the magnitude!

stem( frequencyRange , abs( centered_data_in_freq_domain ) ) ;

xlabel( 'Freq (Hz)' )

ylabel( 'Amplitude' )

title( 'Using the centered FFT function with Amplitude normalisation' )

grid

axis( [ min(frequencyRange) - 0.1 , max(frequencyRange) + 0.1 , 0 , max(abs( centered_data_in_freq_domain )) + 0.1 ] )

fprintf( 'In this centered frequency chart it can be seen that the frequency\n' )

fprintf( 'with the greatest amplitude is 0.05 Hz, i.e. period = 1 / 0.05 = 20\n' )

fprintf( 'which we know to be the correct period of the underlying sine wave.\n' )

fprintf( 'The information within the centered frequency spectrum is entirely symmetric\n' )

fprintf( 'around zero and, in general, the positive side of the spectrum is used.\n\n' )

fprintf( 'Now, let us look at two sine waves together.\n' )

fprintf( 'Press enter to continue.\n\n' )

pause ;

% underlying_sine = 2.0 .* sinewave( period , period ) ; % create underlying sinewave function with amplitude 2

underlying_sine_2 = 0.75 .* sinewave( period , 7 ) ; % create underlying sinewave function with amplitude 0.75

composite_sine = underlying_sine .+ underlying_sine_2 ;

plot( underlying_sine , 'r' , underlying_sine_2 , 'g' , composite_sine , 'b' )

legend( 'Underlying sine period 20' , 'Underlying sine period 7' , 'Combined waveform' )

title( 'Two Sine Waves of periods 20 and 7, with Amplitudes of 2 and 0.75 respectively, combined' )

fprintf( 'After viewing chart, press enter to continue.\n\n' )

pause ;

data_in_freq_domain = fft( composite_sine ) ; % apply the FFT

centered_data_in_freq_domain = fftshift( data_in_freq_domain / N ) ; % normalises & shifts the fft data so that it is centered

% remember to take the abs of data_in_freq_domain to get the magnitude!

stem( frequencyRange , abs( centered_data_in_freq_domain ) ) ;

xlabel( 'Freq (Hz)' )

ylabel( 'Amplitude' )

title( 'Using the centered FFT function with Amplitude normalisation on 2 Sine Waves' )

grid

axis( [ min(frequencyRange) - 0.1 , max(frequencyRange) + 0.1 , 0 , max(abs( centered_data_in_freq_domain )) + 0.1 ] )

fprintf( 'x-axis is frequencyRange.\n' )

frequencyRange

fprintf( '\nComparing the centered frequency chart with the frequencyRange vector now shown it\n' )

fprintf( 'can be seen that, looking at the positive side only, the maximum amplitude\n' )

fprintf( 'frequency is for period = 1 / 0.05 = a 20 period sine wave, and the next greatest\n' )

fprintf( 'amplitude frequency is period = 1 / 0.15 = a 6.6667 period sine wave, which rounds up\n' )

fprintf( 'to a period of 7, both of which are known to be the "correct" periods in the\n' )

fprintf( 'combined waveform. However, we can also see some artifacts in this frequency plot\n' )

fprintf( 'due to "spectral leakage." Now, let us do some filtering and see the plot.\n\n' )

fprintf( 'Press enter to continue.\n\n' )

pause ;

% The actual frequency filtering will be performed on the basic FFT output, remembering that:

% if the number of time domain samples, N, is even:

% element 1 = constant or DC amplitude

% elements 2 to N/2 = amplitudes of positive frequency components in increasing order

% elements N to N/2 = amplitudes of negative frequency components in decreasing order

% Note that element N/2 is the algebraic sum of the highest positive and highest

% negative frequencies and, for real time domain signals, the imaginary

% components cancel and N/2 is always real. The first sinusoidal component

% (fundamental) has it's positive component in element 2 and its negative

% component in element N.

% If the number of time domain samples, N, is odd:

% element 1 = constant or DC amplitude

% elements 2 to (N+1)/2 = amplitudes of positive frequency components in increasing order

% elements N to ((N+1)/2 + 1) = amplitudes of negative frequency components in decreasing order

% Note that for an odd number of samples there is no "middle" element and all

% the frequency domain amplitudes will, in general, be complex.

if mod( N , 2 ) == 0 % N even

% The DC component is unique and should not be altered

% adjust value of element N / 2 to compensate for it being the sum of frequencies

data_in_freq_domain( N / 2 ) = abs( data_in_freq_domain( N / 2 ) ) / 2 ;

[ max1 , ix1 ] = max( abs( data_in_freq_domain( 2 : N / 2 ) ) ) ; % get the index of the first max value

ix1 = ix1 + 1 ;

[ max2 , ix2 ] = max( abs( data_in_freq_domain( N / 2 + 1 : end ) ) ) ; % get index of the second max value

ix2 = N / 2 + ix2 ;

non_zero_values_ix = [ 1 ix1 ix2 ] ; % indices for DC component, +ve freq max & -ve freq max

else % N odd

% The DC component is unique and should not be altered

[ max1 , ix1 ] = max( abs( data_in_freq_domain( 2 : ( N + 1 ) / 2 ) ) ) ; % get the index of the first max value

ix1 = ix1 + 1 ;

[ max2 , ix2 ] = max( abs( data_in_freq_domain( ( N + 1 ) / 2 + 1 : end ) ) ) ; % get index of the second max value

ix2 = ( N + 1 ) / 2 + ix2 ;

non_zero_values_ix = [ 1 ix1 ix2 ] ; % indices for DC component, +ve freq max & -ve freq max

end

% extract the constant term and frequencies of interest

non_zero_values = data_in_freq_domain( non_zero_values_ix ) ;

% now set all values to zero

data_in_freq_domain( 1 : end ) = 0.0 ;

% replace the non_zero_values

data_in_freq_domain( non_zero_values_ix ) = non_zero_values ;

composite_sine_inv = ifft( data_in_freq_domain ) ; % reverse the FFT

recovered_underlying_sine = real( composite_sine_inv ) ; % recover the real component of ifft for plotting

plot( underlying_sine , 'r' , composite_sine , 'g' , recovered_underlying_sine , 'c' )

legend( 'Underlying sine period 20' , 'Composite Sine' , 'Recovered underlying sine' )

title( 'Recovery of Underlying Dominant Sine Wave from Composite Data via FFT filtering' )

fprintf( 'Here we can see that the period 7 sine wave has been removed\n' )

fprintf( 'The trick to smoothing in the frequency domain is to eliminate\n' )

fprintf( '"unwanted frequencies" by setting them to zero in the frequency\n' )

fprintf( 'vector. For the purposes of illustration here the 7 period sine wave\n' )

fprintf( 'is considered noise. After doing this, we reverse the FFT and plot\n' )

fprintf( 'the results. The code that does all this can be seen in the code\n' )

fprintf( 'file. Now let us repeat this with noise.\n\n' )

fprintf( 'Press enter to continue.\n\n' )

pause ;

noise = randn( period , 1 )' * 0.25 ; % create random noise

noisy_composite = composite_sine .+ noise ;

plot( underlying_sine , 'r' , underlying_sine_2 , 'm' , noise, 'k' , noisy_composite , 'g' )

legend( 'Underlying sine period 20' , 'Underlying sine period 7' , 'random noise' , 'Combined waveform' )

title( 'Two Sine Waves of periods 20 and 7, with Amplitudes of 2 and 0.75 respectively, combined with random noise' )

fprintf( 'After viewing chart, press enter to continue.\n\n' )

pause ;

fprintf( 'Running the previous code again on this combined waveform with noise gives\n' )

fprintf( 'this centered plot.\n\n' )

data_in_freq_domain = fft( noisy_composite ) ; % apply the FFT

centered_data_in_freq_domain = fftshift( data_in_freq_domain / N ) ; % normalises & shifts the fft data so that it is centered

% remember to take the abs of data_in_freq_domain to get the magnitude!

stem( frequencyRange , abs( centered_data_in_freq_domain ) ) ;

xlabel( 'Freq (Hz)' )

ylabel( 'Amplitude' )

title( 'Using the centered FFT function with Amplitude normalisation on 2 Sine Waves plus random noise' )

grid

axis( [ min(frequencyRange) - 0.1 , max(frequencyRange) + 0.1 , 0 , max(abs( centered_data_in_freq_domain )) + 0.1 ] )

fprintf( 'Here we can see that the addition of the noise has introduced\n' )

fprintf( 'some unwanted frequencies to the frequency plot. The trick to\n' )

fprintf( 'smoothing in the frequency domain is to eliminate these "unwanted"\n' )

fprintf( 'frequencies by setting them to zero in the frequency vector that is\n' )

fprintf( 'shown in this plot. For the purposes of illustration here,\n' )

fprintf( 'all frequencies other than that for the 20 period sine wave are\n' )

fprintf( 'considered noise. After doing this, we reverse the FFT and plot\n' )

fprintf( 'the results. The code that does all this can be seen in the code\n' )

fprintf( 'file.\n\n' )

fprintf( 'Press enter to view the plotted result.\n\n' )

pause ;

% The actual frequency filtering will be performed on the basic FFT output, remembering that:

% if the number of time domain samples, N, is even:

% element 1 = constant or DC amplitude

% elements 2 to N/2 = amplitudes of positive frequency components in increasing order

% elements N to N/2 = amplitudes of negative frequency components in decreasing order

% Note that element N/2 is the algebraic sum of the highest positive and highest

% negative frequencies and, for real time domain signals, the imaginary

% components cancel and N/2 is always real. The first sinusoidal component

% (fundamental) has it's positive component in element 2 and its negative

% component in element N.

% If the number of time domain samples, N, is odd:

% element 1 = constant or DC amplitude

% elements 2 to (N+1)/2 = amplitudes of positive frequency components in increasing order

% elements N to ((N+1)/2 + 1) = amplitudes of negative frequency components in decreasing order

% Note that for an odd number of samples there is no "middle" element and all

% the frequency domain amplitudes will, in general, be complex.

if mod( N , 2 ) == 0 % N even

% The DC component is unique and should not be altered

% adjust value of element N / 2 to compensate for it being the sum of frequencies

data_in_freq_domain( N / 2 ) = abs( data_in_freq_domain( N / 2 ) ) / 2 ;

[ max1 , ix1 ] = max( abs( data_in_freq_domain( 2 : N / 2 ) ) ) ; % get the index of the first max value

ix1 = ix1 + 1 ;

[ max2 , ix2 ] = max( abs( data_in_freq_domain( N / 2 + 1 : end ) ) ) ; % get index of the second max value

ix2 = N / 2 + ix2 ;

non_zero_values_ix = [ 1 ix1 ix2 ] ; % indices for DC component, +ve freq max & -ve freq max

else % N odd

% The DC component is unique and should not be altered

[ max1 , ix1 ] = max( abs( data_in_freq_domain( 2 : ( N + 1 ) / 2 ) ) ) ; % get the index of the first max value

ix1 = ix1 + 1 ;

[ max2 , ix2 ] = max( abs( data_in_freq_domain( ( N + 1 ) / 2 + 1 : end ) ) ) ; % get index of the second max value

ix2 = ( N + 1 ) / 2 + ix2 ;

non_zero_values_ix = [ 1 ix1 ix2 ] ; % indices for DC component, +ve freq max & -ve freq max

end

% extract the constant term and frequencies of interest

non_zero_values = data_in_freq_domain( non_zero_values_ix ) ;

% now set all values to zero

data_in_freq_domain( 1 : end ) = 0.0 ;

% replace the non_zero_values

data_in_freq_domain( non_zero_values_ix ) = non_zero_values ;

noisy_composite_inv = ifft( data_in_freq_domain ) ; % reverse the FFT

recovered_underlying_sine = real( noisy_composite_inv ) ; % recover the real component of ifft for plotting

plot( underlying_sine , 'r' , noisy_composite , 'g' , recovered_underlying_sine , 'c' )

legend( 'Underlying sine period 20' , 'Noisy Composite' , 'Recovered underlying sine' )

title( 'Recovery of Underlying Dominant Sine Wave from Noisy Composite Data via FFT filtering' )

fprintf( 'As can be seen, the underlying sine wave of period 20 is almost completely\n' )

fprintf( 'recovered using frequency domain filtering. The fact that it is not perfectly\n' )

fprintf( 'recovered is due to artifacts (spectral leakage) intoduced into the frequency spectrum\n' )

fprintf( 'because the individual noisy composite signal components do not begin and end\n' )

fprintf( 'with zero values, or there are not integral numbers of these components present\n' )

fprintf( 'in the sampled, noisy composite signal.\n\n' )

fprintf( 'So there we have it - a basic introduction to using the FFT for signal smoothing\n' )

fprintf( 'in the frequency domain.\n\n' )The last chart output of the script will look something like this.

The red sinusoid represents an underlying periodic signal of period 20 and the green time series is a composite signal of the red line plus a 7 period sinusoid of less amplitude and random noise, these not being shown in the plot. The blue line is the resultant output of FFT filtering in the frequency domain of the green input. I must say I'm pretty pleased with this result and will be doing more work in this area shortly. Stay tuned!

Monday, 15 July 2013

My NN Input Tweak

As I said in my previous post, I wanted to come up with a "principled" method of transforming market data into inputs more suitable for my classification NN, and this post was going to be about how I have investigated various bandpass filters, Fast Fourier transform filters set to eliminate cycles less than the dominant cycle in the data, FIR filters, and a form of the Hilbert-Huang transform. However, while looking to link to another site I happened upon a so-called "Super smoother" filter, but more on this later.

Firstly, I would like to explain how I added realistic "noise" to my normal, idealised market data. Some time ago I looked at, and then abandoned, the idea of using an AFIRMA smoothing algorithm, an example of which is shown below:

The cyan line is the actual data to be smoothed and the red line is an 11 bar, Blackman window function AFIRMA smooth of this data. If one imagines this red smooth to be one realisation of my idealised market data, i.e. the real underlying signal, then the blue data is the signal plus noise. I have taken the measure of the amount of noise present to be the difference between the red and blue lines normalised by the standard deviation of Bollinger bands applied to the red AFIRMA smooth. I did this over all the historical data I have and combined it all into one noise distribution file. When creating my idealised data it is then a simple matter to apply a Bollinger band to it and add un-normalised random samples from this file as noise to create a realistically noisy, idealised time series for testing purposes.

Now for the "super smoother" filter. Details are freely available in the white paper available from here and my Octave C++ .oct file implementation is given in the code box below.

where the red line is a typical example of "true underlying" NN training data, the cyan is the red plus realistic noise as described above, and the yellow is the final "super smoother" filter of the cyan "price". There is a bit of lag in this filter but I'm not unduly concerned with this as it is intended as input to the classification NN, not the market timing NN. Below is a short film of the performance of this filter on the last two years or so of the ES mini S&P contract. The cyan line is the raw input and the red line is the super smoother output.

Non-embedded view here.

Firstly, I would like to explain how I added realistic "noise" to my normal, idealised market data. Some time ago I looked at, and then abandoned, the idea of using an AFIRMA smoothing algorithm, an example of which is shown below:

The cyan line is the actual data to be smoothed and the red line is an 11 bar, Blackman window function AFIRMA smooth of this data. If one imagines this red smooth to be one realisation of my idealised market data, i.e. the real underlying signal, then the blue data is the signal plus noise. I have taken the measure of the amount of noise present to be the difference between the red and blue lines normalised by the standard deviation of Bollinger bands applied to the red AFIRMA smooth. I did this over all the historical data I have and combined it all into one noise distribution file. When creating my idealised data it is then a simple matter to apply a Bollinger band to it and add un-normalised random samples from this file as noise to create a realistically noisy, idealised time series for testing purposes.

Now for the "super smoother" filter. Details are freely available in the white paper available from here and my Octave C++ .oct file implementation is given in the code box below.

#include octave/oct.h

#include octave/dcolvector.h

#include math.h

#define PI 3.14159265

DEFUN_DLD ( super_smoother, args, nargout,

"-*- texinfo -*-\n\

@deftypefn {Function File} {} super_smoother (@var{n})\n\

This function smooths the input column vector by using Elher's\n\

super smoother algorithm set for a 10 bar critical period.\n\

@end deftypefn" )

{

octave_value_list retval_list ;

int nargin = args.length () ;

// check the input arguments

if ( nargin != 1 )

{

error ("Invalid argument. Argument is a column vector of price") ;

return retval_list ;

}

if (args(0).length () < 7 )

{

error ("Invalid argument. Argument is a column vector of price") ;

return retval_list ;

}

if (error_state)

{

error ("Invalid argument. Argument is a column vector of price") ;

return retval_list ;

}

// end of input checking

ColumnVector input = args(0).column_vector_value () ;

ColumnVector output = args(0).column_vector_value () ;

// Declare variables

double a1 = exp( -1.414 * PI / 10.0 ) ;

double b1 = 2.0 * a1 * cos( (1.414*180.0/10.0) * PI / 180.0 ) ;

double c2 = b1 ;

double c3 = -a1 * a1 ;

double c1 = 1.0 - c2 - c3 ;

// main loop

for ( octave_idx_type ii (2) ; ii < args(0).length () ; ii++ )

{

output(ii) = c1 * ( input(ii) + input(ii-1) ) / 2.0 + c2 * output(ii-1) + c3 * output(ii-2) ;

} // end of for loop

retval_list(0) = output ;

return retval_list ;

} // end of function

where the red line is a typical example of "true underlying" NN training data, the cyan is the red plus realistic noise as described above, and the yellow is the final "super smoother" filter of the cyan "price". There is a bit of lag in this filter but I'm not unduly concerned with this as it is intended as input to the classification NN, not the market timing NN. Below is a short film of the performance of this filter on the last two years or so of the ES mini S&P contract. The cyan line is the raw input and the red line is the super smoother output.

Monday, 17 June 2013

Tweaking the Neural Net Inputs

In an attempt to improve my NN system I have recently been thinking of some possibly useful tweaks to the data destined to be the input for the system. Long time readers of this blog will know that the NN system has been trained on my "idealised" data, a typical example of which might look like the red "price series" in the chart below.

These "idealised" series are modelled as simple combinations of linear trend plus a dominant cycle, represented above by the green sine wave at the bottom of the chart. For NN training purposes a mass of training data was created by phase shifting the sine wave and altering the linear trend. However, real data is much more like the cyan "price series," which is modelled as a combination of the linear trend, the dominant or "major" green cycle and a "minor" cyan cycle. It would be possible to create additional NN training data by creating numerous training series comprised of two cycles plus trend, but due to the curse of dimensionality that way madness lies, in addition to the inordinate amount of time it would take to train the NNs.

So the problem becomes one of finding a principled method of transforming the cyan "real data" to be more like the "idealised" red data my NNs were trained on, and a possible answer might be the use of my bandpass indicator. Shown below is a chart of said bandpass indicator overlaid on the above chart, in yellow. The bandpass is set to pass only the "minor" cycle and then this is subtracted from the "real data" to give an

approximation of the red "idealised" data. This particular instance calculates the bandpass with a moving window with a look back length set to the period of the "minor" cycle, whilst the following is a fully recursive implementation. It can be seen that this

recursive implementation is much better on this contrived toy example. However, I think this method shows promise and I intend to pursue it further. More in due course.

These "idealised" series are modelled as simple combinations of linear trend plus a dominant cycle, represented above by the green sine wave at the bottom of the chart. For NN training purposes a mass of training data was created by phase shifting the sine wave and altering the linear trend. However, real data is much more like the cyan "price series," which is modelled as a combination of the linear trend, the dominant or "major" green cycle and a "minor" cyan cycle. It would be possible to create additional NN training data by creating numerous training series comprised of two cycles plus trend, but due to the curse of dimensionality that way madness lies, in addition to the inordinate amount of time it would take to train the NNs.

So the problem becomes one of finding a principled method of transforming the cyan "real data" to be more like the "idealised" red data my NNs were trained on, and a possible answer might be the use of my bandpass indicator. Shown below is a chart of said bandpass indicator overlaid on the above chart, in yellow. The bandpass is set to pass only the "minor" cycle and then this is subtracted from the "real data" to give an

approximation of the red "idealised" data. This particular instance calculates the bandpass with a moving window with a look back length set to the period of the "minor" cycle, whilst the following is a fully recursive implementation. It can be seen that this

recursive implementation is much better on this contrived toy example. However, I think this method shows promise and I intend to pursue it further. More in due course.

Tuesday, 11 June 2013

Random Permutation of Price Series

As a prelude to the tests mentioned in my previous post it has been necessary to write code to randomly permute price data, and in the code box below is the Octave .oct file I have written to do this.

where the yellow is the real ( in this case S & P 500 ) data and the red and blue bars are a typical example of a single permutation run. This next screen shot shows that part of the above where the two series overlap on the right hand side, so that the details can be visually compared.

The purpose and necessity for this will be explained in a future post, where the planned tests will be discussed in more detail.

#include octave oct.h

#include octave dcolvector.h

#include math.h

#include algorithm

#include "MersenneTwister.h"

DEFUN_DLD (randomised_price_data, args, , "Inputs are OHLC column vectors and tick size. Output is permuted synthetic OHLC")

{

octave_value_list retval_list ;

int nargin = args.length () ;

int vec_length = args(0).length () - 1 ;

if ( nargin != 5 )

{

error ("Invalid arguments. Inputs are OHLC column vectors and tick size.") ;

return retval_list ;

}

if (args(0).length () < 50)

{

error ("Invalid arguments. Inputs are OHLC column vectors and tick size.") ;

return retval_list ;

}

if (error_state)

{

error ("Invalid arguments. Inputs are OHLC column vectors and tick size.") ;

return retval_list ;

}

ColumnVector open = args(0).column_vector_value () ; // open vector

ColumnVector high = args(1).column_vector_value () ; // high vector

ColumnVector low = args(2).column_vector_value () ; // low vector

ColumnVector close = args(3).column_vector_value () ; // close vector

double tick = args(4).double_value(); // Tick size

//double trend_increment = ( close ( args(3).length () - 1 ) - close (0) ) / ( args(3).length () - 1 ) ;

ColumnVector open_change_var ( vec_length ) ;

ColumnVector high_change_var ( vec_length ) ;

ColumnVector low_change_var ( vec_length ) ;

ColumnVector close_change_var ( vec_length ) ;

// variables for shuffling

double temp ;

int k1 ;

int k2 ;

// Check for negative or zero price values due to continuous back- adjusting of price series & compensate if necessary

// Note: the "&" below acts as Address-of operator: p = &x; Read: Assign to p (a pointer) the address of x.

double lowest_low = *std::min_element( &low(0), &low(low.length()) ) ;

double correction_factor = 0.0 ;

if ( lowest_low <= 0.0 )

{

correction_factor = fabs(lowest_low) + tick;

for (octave_idx_type ii (0); ii < args(0).length (); ii++)

{

open (ii) = open (ii) + correction_factor;

high (ii) = high (ii) + correction_factor;

low (ii) = low (ii) + correction_factor;

close (ii) = close (ii) + correction_factor;

}

}

// fill the change vectors with their values

for ( octave_idx_type ii (1) ; ii < args(0).length () ; ii++ )

{

// comment out/uncomment depending on whether to include a relationship to previous bar's volatility or not

// No relationship

// open_change_var (ii-1) = log10( open (ii) / close (ii) ) ;

// high_change_var (ii-1) = log10( high (ii) / close (ii) ) ;

// low_change_var (ii-1) = log10( low (ii) / close (ii) ) ;

// some relationship

open_change_var (ii-1) = ( close (ii) - open (ii) ) / ( high (ii-1) - low (ii-1) ) ;

high_change_var (ii-1) = ( close (ii) - high (ii) ) / ( high (ii-1) - low (ii-1) ) ;

low_change_var (ii-1) = ( close (ii) - low (ii) ) / ( high (ii-1) - low (ii-1) ) ;

close_change_var (ii-1) = log10( close(ii) / close(ii-1) ) ;

}

// Shuffle the log vectors

MTRand mtrand1 ; // Declare the Mersenne Twister Class - will seed from system time

k1 = vec_length - 1 ; // initialise prior to shuffling

while ( k1 > 0 ) // While at least 2 left to shuffle

{

k2 = mtrand1.randInt( k1 ) ; // Pick an int from 0 through k1

if ( k2 > k1 ) // check if random vector index no. k2 is > than max vector index - should never happen

{

k2 = k1 - 1 ; // But this is cheap insurance against disaster if it does happen

}

temp = open_change_var (k1) ; // allocate the last vector index content to temp

open_change_var (k1) = open_change_var (k2) ; // allocate random pick to the last vector index

open_change_var (k2) = temp ; // allocate temp content to old vector index position of random pick

temp = high_change_var (k1) ; // allocate the last vector index content to temp

high_change_var (k1) = high_change_var (k2) ; // allocate random pick to the last vector index

high (k2) = temp ; // allocate temp content to old vector index position of random pick

temp = low_change_var (k1) ; // allocate the last vector index content to temp

low_change_var (k1) = low_change_var (k2) ; // allocate random pick to the last vector index

low_change_var (k2) = temp ; // allocate temp content to old vector index position of random pick

temp = close_change_var (k1) ; // allocate the last vector index content to temp

close_change_var (k1) = close_change_var (k2) ; // allocate random pick to the last vector index

close_change_var (k2) = temp ; // allocate temp content to old vector index position of random pick

k1 = k1 - 1 ; // count down

} // Shuffling is complete when this while loop exits

// create the new shuffled price series and round to nearest tick

for ( octave_idx_type ii (1) ; ii < args(0).length () ; ii++ )

{

close (ii) = ( floor( ( close (ii-1) * pow( 10, close_change_var(ii-1) ) ) / tick + 0.5 ) ) * tick ;

// comment out/uncomment depending on whether to include a relationship to previous bar's volatility or not

// no relationship

// open (ii) = ( floor( ( close (ii) * pow( 10, open_change_var(ii-1) ) ) / tick + 0.5 ) ) * tick ;

// high (ii) = ( floor( ( close (ii) * pow( 10, high_change_var(ii-1) ) ) / tick + 0.5 ) ) * tick ;

// low (ii) = ( floor( ( close (ii) * pow( 10, low_change_var(ii-1) ) ) / tick + 0.5 ) ) * tick ;

// some relationship

open (ii) = ( floor( ( open_change_var(ii-1) * ( high (ii-1) - low (ii-1) ) + close (ii) ) / tick + 0.5 ) ) * tick ;

high (ii) = ( floor( ( high_change_var(ii-1) * ( high (ii-1) - low (ii-1) ) + close (ii) ) / tick + 0.5 ) ) * tick ;

low (ii) = ( floor( ( low_change_var(ii-1) * ( high (ii-1) - low (ii-1) ) + close (ii) ) / tick + 0.5 ) ) * tick ;

}

// if compensation due to negative or zero original price values due to continuous back- adjusting of price series took place, re-adjust

if ( correction_factor != 0.0 )

{

for ( octave_idx_type ii (0); ii < args(0).length () ; ii++ )

{

open (ii) = open (ii) - correction_factor ;

high (ii) = high (ii) - correction_factor ;

low (ii) = low (ii) - correction_factor ;

close (ii) = close (ii) - correction_factor ;

}

}

retval_list (3) = close ;

retval_list (2) = low ;

retval_list (1) = high ;

retval_list (0) = open ;

return retval_list ;

} // end of function

// MersenneTwister.h

// Mersenne Twister random number generator -- a C++ class MTRand

// Based on code by Makoto Matsumoto, Takuji Nishimura, and Shawn Cokus

// Richard J. Wagner v1.1 28 September 2009 wagnerr@umich.edu

// The Mersenne Twister is an algorithm for generating random numbers. It

// was designed with consideration of the flaws in various other generators.

// The period, 2^19937-1, and the order of equidistribution, 623 dimensions,

// are far greater. The generator is also fast; it avoids multiplication and

// division, and it benefits from caches and pipelines. For more information

// see the inventors' web page at

// http://www.math.sci.hiroshima-u.ac.jp/~m-mat/MT/emt.html

// Reference

// M. Matsumoto and T. Nishimura, "Mersenne Twister: A 623-Dimensionally

// Equidistributed Uniform Pseudo-Random Number Generator", ACM Transactions on

// Modeling and Computer Simulation, Vol. 8, No. 1, January 1998, pp 3-30.

// Copyright (C) 1997 - 2002, Makoto Matsumoto and Takuji Nishimura,

// Copyright (C) 2000 - 2009, Richard J. Wagner

// All rights reserved.

//

// Redistribution and use in source and binary forms, with or without

// modification, are permitted provided that the following conditions

// are met:

//

// 1. Redistributions of source code must retain the above copyright

// notice, this list of conditions and the following disclaimer.

//

// 2. Redistributions in binary form must reproduce the above copyright

// notice, this list of conditions and the following disclaimer in the

// documentation and/or other materials provided with the distribution.

//

// 3. The names of its contributors may not be used to endorse or promote

// products derived from this software without specific prior written

// permission.

//

// THIS SOFTWARE IS PROVIDED BY THE COPYRIGHT HOLDERS AND CONTRIBUTORS "AS IS"

// AND ANY EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, THE

// IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE

// ARE DISCLAIMED. IN NO EVENT SHALL THE COPYRIGHT OWNER OR CONTRIBUTORS BE

// LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, SPECIAL, EXEMPLARY, OR

// CONSEQUENTIAL DAMAGES (INCLUDING, BUT NOT LIMITED TO, PROCUREMENT OF

// SUBSTITUTE GOODS OR SERVICES; LOSS OF USE, DATA, OR PROFITS; OR BUSINESS

// INTERRUPTION) HOWEVER CAUSED AND ON ANY THEORY OF LIABILITY, WHETHER IN

// CONTRACT, STRICT LIABILITY, OR TORT (INCLUDING NEGLIGENCE OR OTHERWISE)

// ARISING IN ANY WAY OUT OF THE USE OF THIS SOFTWARE, EVEN IF ADVISED OF THE

// POSSIBILITY OF SUCH DAMAGE.

// The original code included the following notice:

//

// When you use this, send an email to: m-mat@math.sci.hiroshima-u.ac.jp

// with an appropriate reference to your work.

//

// It would be nice to CC: wagnerr@umich.edu and Cokus@math.washington.edu

// when you write.

#ifndef MERSENNETWISTER_H

#define MERSENNETWISTER_H

// Not thread safe (unless auto-initialization is avoided and each thread has

// its own MTRand object)

#include

#include

#include

#include

#include

class MTRand {

// Data

public:

typedef unsigned long uint32; // unsigned integer type, at least 32 bits

enum { N = 624 }; // length of state vector

enum { SAVE = N + 1 }; // length of array for save()

protected:

enum { M = 397 }; // period parameter

uint32 state[N]; // internal state

uint32 *pNext; // next value to get from state

int left; // number of values left before reload needed

// Methods

public:

MTRand( const uint32 oneSeed ); // initialize with a simple uint32

MTRand( uint32 *const bigSeed, uint32 const seedLength = N ); // or array

MTRand(); // auto-initialize with /dev/urandom or time() and clock()

MTRand( const MTRand& o ); // copy

// Do NOT use for CRYPTOGRAPHY without securely hashing several returned

// values together, otherwise the generator state can be learned after

// reading 624 consecutive values.

// Access to 32-bit random numbers

uint32 randInt(); // integer in [0,2^32-1]

uint32 randInt( const uint32 n ); // integer in [0,n] for n < 2^32

double rand(); // real number in [0,1]

double rand( const double n ); // real number in [0,n]

double randExc(); // real number in [0,1)

double randExc( const double n ); // real number in [0,n)

double randDblExc(); // real number in (0,1)

double randDblExc( const double n ); // real number in (0,n)

double operator()(); // same as rand()

// Access to 53-bit random numbers (capacity of IEEE double precision)

double rand53(); // real number in [0,1)

// Access to nonuniform random number distributions

double randNorm( const double mean = 0.0, const double stddev = 1.0 );

// Re-seeding functions with same behavior as initializers

void seed( const uint32 oneSeed );

void seed( uint32 *const bigSeed, const uint32 seedLength = N );

void seed();

// Saving and loading generator state

void save( uint32* saveArray ) const; // to array of size SAVE

void load( uint32 *const loadArray ); // from such array

friend std::ostream& operator<<( std::ostream& os, const MTRand& mtrand );

friend std::istream& operator>>( std::istream& is, MTRand& mtrand );

MTRand& operator=( const MTRand& o );

protected:

void initialize( const uint32 oneSeed );

void reload();

uint32 hiBit( const uint32 u ) const { return u & 0x80000000UL; }

uint32 loBit( const uint32 u ) const { return u & 0x00000001UL; }

uint32 loBits( const uint32 u ) const { return u & 0x7fffffffUL; }

uint32 mixBits( const uint32 u, const uint32 v ) const

{ return hiBit(u) | loBits(v); }

uint32 magic( const uint32 u ) const

{ return loBit(u) ? 0x9908b0dfUL : 0x0UL; }

uint32 twist( const uint32 m, const uint32 s0, const uint32 s1 ) const

{ return m ^ (mixBits(s0,s1)>>1) ^ magic(s1); }

static uint32 hash( time_t t, clock_t c );

};

// Functions are defined in order of usage to assist inlining

inline MTRand::uint32 MTRand::hash( time_t t, clock_t c )

{

// Get a uint32 from t and c

// Better than uint32(x) in case x is floating point in [0,1]

// Based on code by Lawrence Kirby (fred@genesis.demon.co.uk)

static uint32 differ = 0; // guarantee time-based seeds will change

uint32 h1 = 0;

unsigned char *p = (unsigned char *) &t;

for( size_t i = 0; i < sizeof(t); ++i )

{

h1 *= UCHAR_MAX + 2U;

h1 += p[i];

}

uint32 h2 = 0;

p = (unsigned char *) &c;

for( size_t j = 0; j < sizeof(c); ++j )

{

h2 *= UCHAR_MAX + 2U;

h2 += p[j];

}

return ( h1 + differ++ ) ^ h2;

}

inline void MTRand::initialize( const uint32 seed )

{

// Initialize generator state with seed

// See Knuth TAOCP Vol 2, 3rd Ed, p.106 for multiplier.

// In previous versions, most significant bits (MSBs) of the seed affect

// only MSBs of the state array. Modified 9 Jan 2002 by Makoto Matsumoto.

register uint32 *s = state;

register uint32 *r = state;

register int i = 1;

*s++ = seed & 0xffffffffUL;

for( ; i < N; ++i )

{

*s++ = ( 1812433253UL * ( *r ^ (*r >> 30) ) + i ) & 0xffffffffUL;

r++;

}

}

inline void MTRand::reload()

{

// Generate N new values in state

// Made clearer and faster by Matthew Bellew (matthew.bellew@home.com)

static const int MmN = int(M) - int(N); // in case enums are unsigned

register uint32 *p = state;

register int i;

for( i = N - M; i--; ++p )

*p = twist( p[M], p[0], p[1] );

for( i = M; --i; ++p )

*p = twist( p[MmN], p[0], p[1] );

*p = twist( p[MmN], p[0], state[0] );

left = N, pNext = state;

}

inline void MTRand::seed( const uint32 oneSeed )

{

// Seed the generator with a simple uint32

initialize(oneSeed);

reload();

}

inline void MTRand::seed( uint32 *const bigSeed, const uint32 seedLength )

{

// Seed the generator with an array of uint32's

// There are 2^19937-1 possible initial states. This function allows

// all of those to be accessed by providing at least 19937 bits (with a

// default seed length of N = 624 uint32's). Any bits above the lower 32

// in each element are discarded.

// Just call seed() if you want to get array from /dev/urandom

initialize(19650218UL);

register int i = 1;

register uint32 j = 0;

register int k = ( N > seedLength ? N : seedLength );

for( ; k; --k )

{

state[i] =

state[i] ^ ( (state[i-1] ^ (state[i-1] >> 30)) * 1664525UL );

state[i] += ( bigSeed[j] & 0xffffffffUL ) + j;

state[i] &= 0xffffffffUL;

++i; ++j;

if( i >= N ) { state[0] = state[N-1]; i = 1; }

if( j >= seedLength ) j = 0;

}

for( k = N - 1; k; --k )

{

state[i] =

state[i] ^ ( (state[i-1] ^ (state[i-1] >> 30)) * 1566083941UL );

state[i] -= i;

state[i] &= 0xffffffffUL;

++i;

if( i >= N ) { state[0] = state[N-1]; i = 1; }

}

state[0] = 0x80000000UL; // MSB is 1, assuring non-zero initial array

reload();

}

inline void MTRand::seed()

{

// Seed the generator with an array from /dev/urandom if available

// Otherwise use a hash of time() and clock() values

// First try getting an array from /dev/urandom

FILE* urandom = fopen( "/dev/urandom", "rb" );

if( urandom )

{

uint32 bigSeed[N];

register uint32 *s = bigSeed;

register int i = N;

register bool success = true;

while( success && i-- )

success = fread( s++, sizeof(uint32), 1, urandom );

fclose(urandom);

if( success ) { seed( bigSeed, N ); return; }

}

// Was not successful, so use time() and clock() instead

seed( hash( time(NULL), clock() ) );

}

inline MTRand::MTRand( const uint32 oneSeed )

{ seed(oneSeed); }

inline MTRand::MTRand( uint32 *const bigSeed, const uint32 seedLength )

{ seed(bigSeed,seedLength); }

inline MTRand::MTRand()

{ seed(); }

inline MTRand::MTRand( const MTRand& o )

{

register const uint32 *t = o.state;

register uint32 *s = state;

register int i = N;

for( ; i--; *s++ = *t++ ) {}

left = o.left;

pNext = &state[N-left];

}

inline MTRand::uint32 MTRand::randInt()

{

// Pull a 32-bit integer from the generator state

// Every other access function simply transforms the numbers extracted here

if( left == 0 ) reload();

--left;

register uint32 s1;

s1 = *pNext++;

s1 ^= (s1 >> 11);

s1 ^= (s1 << 7) & 0x9d2c5680UL;

s1 ^= (s1 << 15) & 0xefc60000UL;

return ( s1 ^ (s1 >> 18) );

}

inline MTRand::uint32 MTRand::randInt( const uint32 n )

{

// Find which bits are used in n

// Optimized by Magnus Jonsson (magnus@smartelectronix.com)

uint32 used = n;

used |= used >> 1;

used |= used >> 2;

used |= used >> 4;

used |= used >> 8;

used |= used >> 16;

// Draw numbers until one is found in [0,n]

uint32 i;

do

i = randInt() & used; // toss unused bits to shorten search

while( i > n );

return i;

}

inline double MTRand::rand()

{ return double(randInt()) * (1.0/4294967295.0); }

inline double MTRand::rand( const double n )

{ return rand() * n; }

inline double MTRand::randExc()

{ return double(randInt()) * (1.0/4294967296.0); }

inline double MTRand::randExc( const double n )

{ return randExc() * n; }

inline double MTRand::randDblExc()

{ return ( double(randInt()) + 0.5 ) * (1.0/4294967296.0); }

inline double MTRand::randDblExc( const double n )

{ return randDblExc() * n; }

inline double MTRand::rand53()

{

uint32 a = randInt() >> 5, b = randInt() >> 6;

return ( a * 67108864.0 + b ) * (1.0/9007199254740992.0); // by Isaku Wada

}

inline double MTRand::randNorm( const double mean, const double stddev )

{

// Return a real number from a normal (Gaussian) distribution with given

// mean and standard deviation by polar form of Box-Muller transformation

double x, y, r;

do

{

x = 2.0 * rand() - 1.0;

y = 2.0 * rand() - 1.0;

r = x * x + y * y;

}

while ( r >= 1.0 || r == 0.0 );

double s = sqrt( -2.0 * log(r) / r );

return mean + x * s * stddev;

}

inline double MTRand::operator()()

{

return rand();

}

inline void MTRand::save( uint32* saveArray ) const

{

register const uint32 *s = state;

register uint32 *sa = saveArray;

register int i = N;

for( ; i--; *sa++ = *s++ ) {}

*sa = left;

}

inline void MTRand::load( uint32 *const loadArray )

{

register uint32 *s = state;

register uint32 *la = loadArray;

register int i = N;

for( ; i--; *s++ = *la++ ) {}

left = *la;

pNext = &state[N-left];

}

inline std::ostream& operator<<( std::ostream& os, const MTRand& mtrand )

{

register const MTRand::uint32 *s = mtrand.state;

register int i = mtrand.N;

for( ; i--; os << *s++ << "\t" ) {}

return os << mtrand.left;

}

inline std::istream& operator>>( std::istream& is, MTRand& mtrand )

{

register MTRand::uint32 *s = mtrand.state;

register int i = mtrand.N;

for( ; i--; is >> *s++ ) {}

is >> mtrand.left;

mtrand.pNext = &mtrand.state[mtrand.N-mtrand.left];

return is;

}

inline MTRand to standard forms

// - Cleaned declarations and definitions to please Intel compiler

// - Revised twist() operator to work on ones'-complement machines

// - Fixed reload() function to work when N and M are unsigned

// - Added copy constructor and copy operator from Salvador Espana

// example.cpp

// Examples of random number generation with MersenneTwister.h

// Richard J. Wagner 27 September 2009

#include iostream

#include fstream

#include "MersenneTwister.h"

using namespace std;

int main( int argc, char * const argv[] )

{

// A Mersenne Twister random number generator

// can be declared with a simple

MTRand mtrand1;

// and used with

double a = mtrand1();

// or

double b = mtrand1.rand();

cout << "Two real numbers in the range [0,1]: ";

cout << a << ", " << b << endl;

// Those calls produced the default of floating-point numbers

// in the range 0 to 1, inclusive. We can also get integers

// in the range 0 to 2^32 - 1 (4294967295) with

unsigned long c = mtrand1.randInt();

cout << "An integer in the range [0," << 0xffffffffUL;

cout << "]: " << c << endl;

// Or get an integer in the range 0 to n (for n < 2^32) with

int d = mtrand1.randInt( 42 );

cout << "An integer in the range [0,42]: " << d << endl;

// We can get a real number in the range 0 to 1, excluding

// 1, with

double e = mtrand1.randExc();

cout << "A real number in the range [0,1): " << e << endl;

// We can get a real number in the range 0 to 1, excluding

// both 0 and 1, with

double f = mtrand1.randDblExc();

cout << "A real number in the range (0,1): " << f << endl;

// The functions rand(), randExc(), and randDblExc() can

// also have ranges defined just like randInt()

double g = mtrand1.rand( 2.5 );

double h = mtrand1.randExc( 10.0 );

double i = 12.0 + mtrand1.randDblExc( 8.0 );

cout << "A real number in the range [0,2.5]: " << g << endl;

cout << "One in the range [0,10.0): " << h << endl;

cout << "And one in the range (12.0,20.0): " << i << endl;

// The distribution of numbers over each range is uniform,

// but it can be transformed to other useful distributions.

// One common transformation is included for drawing numbers

// in a normal (Gaussian) distribution

cout << "A few grades from a class with a 52 pt average ";

cout << "and a 9 pt standard deviation:" << endl;

for( int student = 0; student < 20; ++student )

{

double j = mtrand1.randNorm( 52.0, 9.0 );

cout << ' ' << int(j);

}

cout << endl;

// Random number generators need a seed value to start

// producing a sequence of random numbers. We gave no seed

// in our declaration of mtrand1, so one was automatically

// generated from the system clock (or the operating system's

// random number pool if available). Alternatively we could

// provide our own seed. Each seed uniquely determines the

// sequence of numbers that will be produced. We can

// replicate a sequence by starting another generator with

// the same seed.

MTRand mtrand2a( 1973 ); // makes new MTRand with given seed

double k1 = mtrand2a(); // gets the first number generated

MTRand mtrand2b( 1973 ); // makes an identical MTRand

double k2 = mtrand2b(); // and gets the same number

cout << "These two numbers are the same: ";

cout << k1 << ", " << k2 << endl;

// We can also restart an existing MTRand with a new seed

mtrand2a.seed( 1776 );

mtrand2b.seed( 1941 );

double l1 = mtrand2a();

double l2 = mtrand2b();

cout << "Re-seeding gives different numbers: ";

cout << l1 << ", " << l2 << endl;

// But there are only 2^32 possible seeds when we pass a

// single 32-bit integer. Since the seed dictates the

// sequence, only 2^32 different random number sequences will

// result. For applications like Monte Carlo simulation we

// might want many more. We can seed with an array of values

// rather than a single integer to access the full 2^19937-1

// possible sequences.

MTRand::uint32 seed[ MTRand::N ];

for( int n = 0; n < MTRand::N; ++n )

seed[n] = 23 * n; // fill with anything

MTRand mtrand3( seed );

double m1 = mtrand3();

double m2 = mtrand3();

double m3 = mtrand3();

cout << "We seeded this sequence with 19968 bits: ";

cout << m1 << ", " << m2 << ", " << m3 << endl;

// Again we will have the same sequence every time we run the

// program. Make the array with something that will change

// to get unique sequences. On a Linux system, the default

// auto-initialization routine takes a unique sequence from

// /dev/urandom.

// For cryptography, also remember to hash the generated

// random numbers. Otherwise the internal state of the

// generator can be learned after reading 624 values.

// We might want to save the state of the generator at an

// arbitrary point after seeding so a sequence could be

// replicated. An MTRand object can be saved into an array

// or to a stream.

MTRand mtrand4;

// The array must be of type uint32 and length SAVE.

MTRand::uint32 randState[ MTRand::SAVE ];

mtrand4.save( randState );

// A stream is convenient for saving to a file.

ofstream stateOut( "state.dat" );

if( stateOut )

{

stateOut << mtrand4;

stateOut.close();

}

unsigned long n1 = mtrand4.randInt();

unsigned long n2 = mtrand4.randInt();

unsigned long n3 = mtrand4.randInt();

cout << "A random sequence: "

<< n1 << ", " << n2 << ", " << n3 << endl;

// And loading the saved state is as simple as

mtrand4.load( randState );

unsigned long o4 = mtrand4.randInt();

unsigned long o5 = mtrand4.randInt();

unsigned long o6 = mtrand4.randInt();

cout << "Restored from an array: "

<< o4 << ", " << o5 << ", " << o6 << endl;

ifstream stateIn( "state.dat" );

if( stateIn )

{

stateIn >> mtrand4;

stateIn.close();

}

unsigned long p7 = mtrand4.randInt();

unsigned long p8 = mtrand4.randInt();

unsigned long p9 = mtrand4.randInt();

cout << "Restored from a stream: "

<< p7 << ", " << p8 << ", " << p9 << endl;

// We can also duplicate a generator by copying

MTRand mtrand5( mtrand3 ); // copy upon construction

double q1 = mtrand3();

double q2 = mtrand5();

cout << "These two numbers are the same: ";

cout << q1 << ", " << q2 << endl;

mtrand5 = mtrand4; // copy by assignment

double r1 = mtrand4();

double r2 = mtrand5();

cout << "These two numbers are the same: ";

cout << r1 << ", " << r2 << endl;

// In summary, the recommended common usage is

MTRand mtrand6; // automatically generate seed

double s = mtrand6(); // real number in [0,1]

double t = mtrand6.randExc(0.5); // real number in [0,0.5)

unsigned long u = mtrand6.randInt(10); // integer in [0,10]

// with the << and >> operators used for saving to and

// loading from streams if needed.

cout << "Your lucky number for today is "

<< s + t * u << endl;

return 0;

} where the yellow is the real ( in this case S & P 500 ) data and the red and blue bars are a typical example of a single permutation run. This next screen shot shows that part of the above where the two series overlap on the right hand side, so that the details can be visually compared.

The purpose and necessity for this will be explained in a future post, where the planned tests will be discussed in more detail.

Labels:

Gnuplot,

Monte Carlo Permutation,

Octave,

Synthetic Data

Thursday, 6 June 2013

First Version of Neural Net System Complete

I am pleased to say that my first NN "system" has now been sufficiently trained to subject it to testing. The system consists of my NN classifier, as mentioned in previous posts, along with a "directional" NN to indicate a long, short or neutral position bias. There are 205 separate NNs, 41 "classifying" NNs for measured cyclic periods of 10 to 50 inclusive, and for each period 5 "directional" NNs have been trained. The way these work is:

Below are shown some recent charts showing the "position bias" that results from the above. Blue is long, red is short and white is neutral.

- at each new bar the current dominant cycle period is measured, e.g 25 bars

- the "classifying" NN for period 25 is then run to determine the current "market mode," which will be one of my 5 postulated market types

- the "directional" NN for period 25 and the identified "market mode" is then run to assign a "position bias" for the most recent bar

Below are shown some recent charts showing the "position bias" that results from the above. Blue is long, red is short and white is neutral.

S & P 500

Gold

Treasury Bonds

Dollar Index

West Texas Oil

World Sugar

I intend these "position biases" to be a set up condition for use with a specific entry and exit logic. I now need to code this up and test it. The test I have in mind is a Monte Carlo Permutation test, which is nicely discussed in the Permutation Training section (page 306 onwards) in the Tutorial PDF available from the downloads page on the TSSB page.

I would stress that this is a first implementation of my NN trading system and I fully expect that it could be improved. However, before I undertake any more development I want to be sure that I am on the right track. My future work flow will be something like this:-

- code the above mentioned entry and exit logic

- code the MC test routine and conduct tests

- if these MC tests show promise, rewrite my Octave NN training code in C++ .oct code to speed up the NN training

- improve the classification NNs by increasing/varying the amount of training data, and possibly introducing new discriminant features

- do the same with the directional NNs

Subscribe to:

Comments (Atom)